unified estate tax credit 2021

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax.

Estate Tax In The United States Wikipedia

New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax.

. Free shipping on qualified orders. Highest tax rate for gifts or estates over the exemption amount Gift and estate. The unified tax credit.

What Is the Unified Tax Credit Amount for 2021. That leaves 1 million above the. A uses 9 million of the available BEA to reduce the gift tax to zero.

The Unified Tax Credit exempts 117 million. It consists of an. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

Were Here to Help You with All of Your Estate Planning Needs. You must own or rent residential property in Massachusetts and occupy it as. A dies in 2026.

Ad Massachusetts Estate Planning Law Firm Specializing in Wills Trusts and Estates. The amount with respect to which the tentative tax is determined under section. Considering that inherited assets from an estate are currently taxed at 40.

It will then be taken as a credit against any estate tax owed. The unified tax credit is an exemption limit that applies both to taxable gifts. With inflation this may land somewhere around 6 million.

The Estate Tax is a tax on your right to transfer property at your death. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. In addition any portion of the.

Free easy returns on millions of items. Unified Rate Schedule Taxable Amount Estate Tax Rate What Your Estate Owes. Texas Complex Will - Maximum Unified Credit to Spouse.

In the case of a taxpayer who rents his or her principal residence the credit is. Ad Real Estate Family Planning Estate Planning and Power of Attorney Requirements.

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

2016 Federal Estate Tax Exemption Amount Wills Trusts And Estates

U S Estate Tax For Canadians Manulife Investment Management

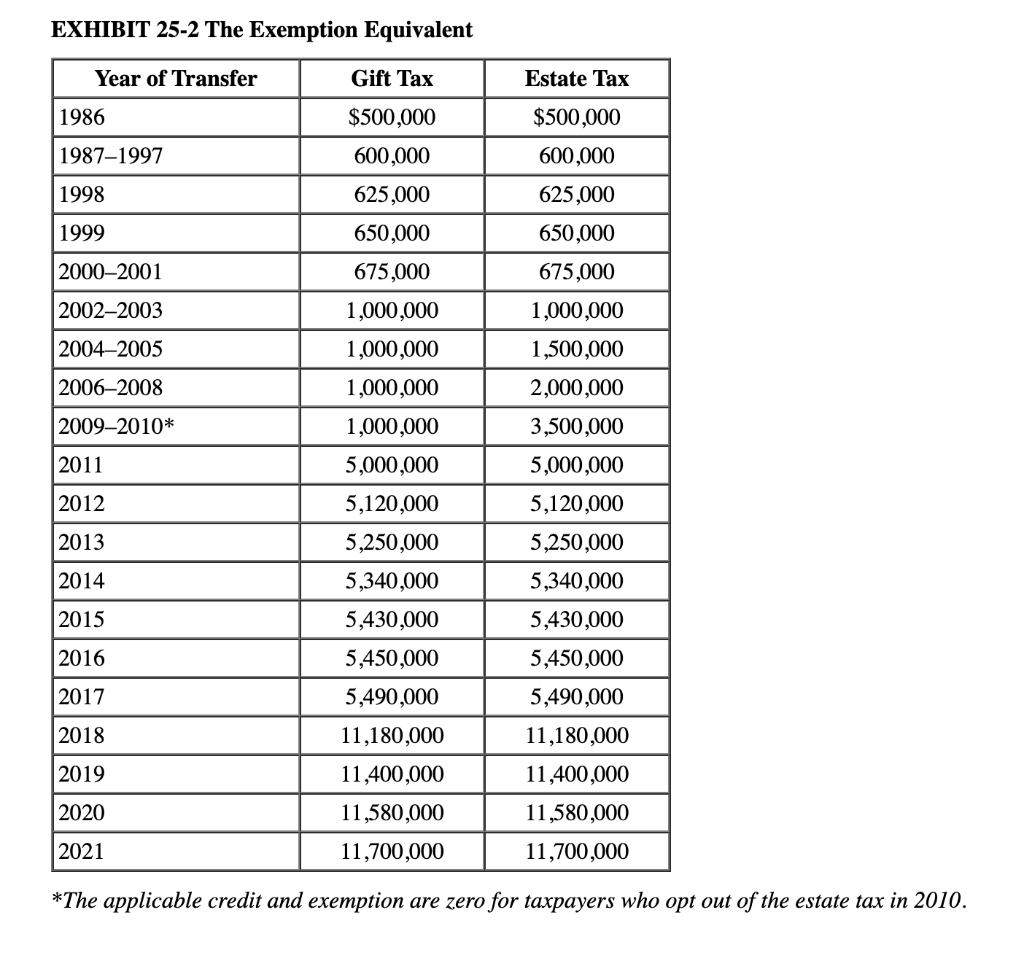

History Of The Unified Tax Credit Apple Growth Partners

New Tax Exemption Amounts 2022 Estate Planning Jah

The Estate Tax And Lifetime Gifting Charles Schwab

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

A Guide To Estate Taxes Mass Gov

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

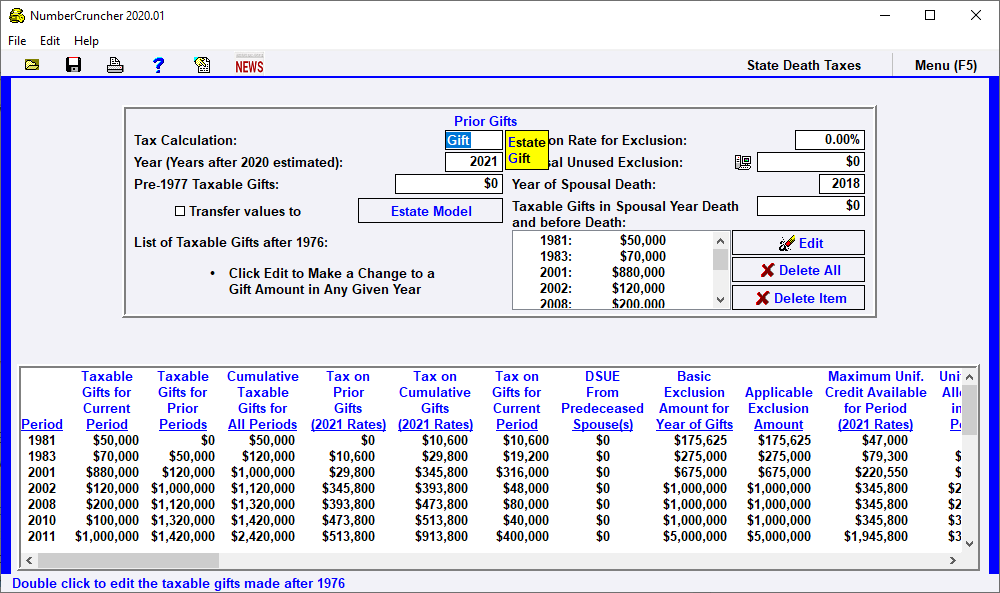

Solved Hello Ch Tutor Can You Explained This Assignment Thanks Course Hero

Proposed Changes To The Federal Estate Gift Tax Exemption Brmm

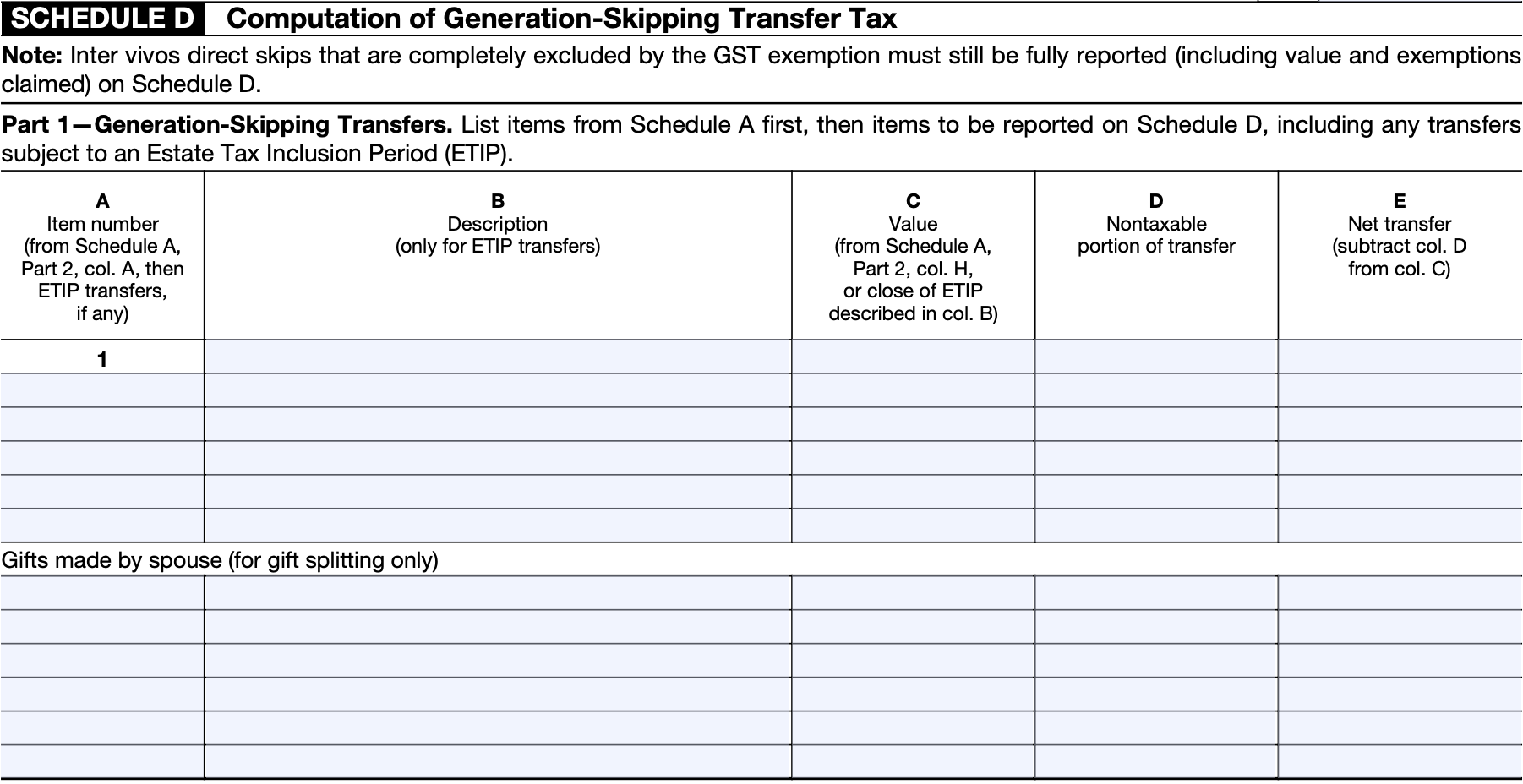

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Warshaw Burstein Llp 2022 Trust And Estates Updates

Estate Planning Key Numbers Brian Nydegger

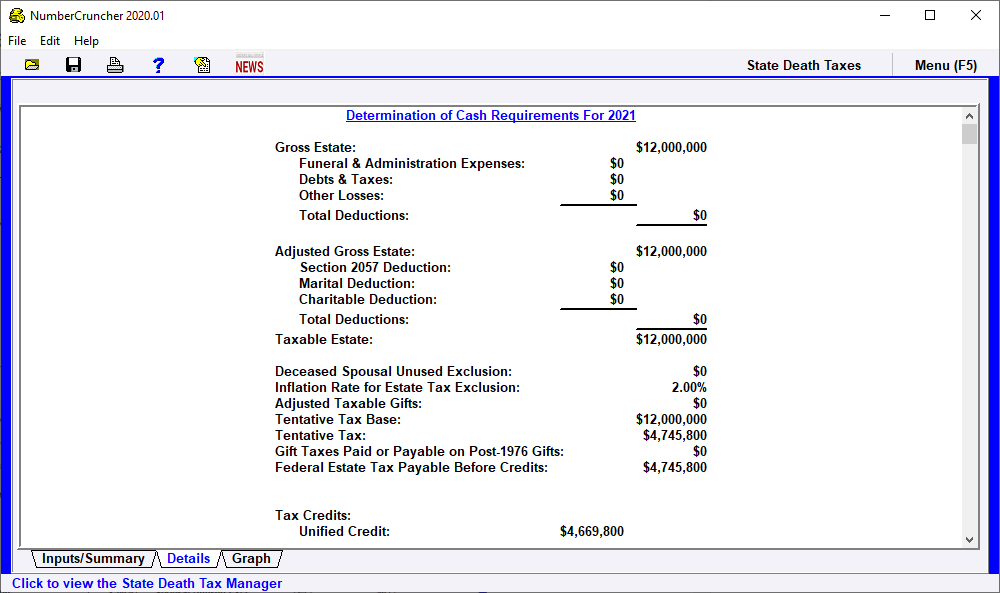

Cash Need Determination Of Cash Requirements Leimberg Leclair Lackner Inc

Creating Estate Tax Plans Under The Biden Administration

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com